Salon Expenses List 2025: Essential Costs for Starting and Running a Salon

Creating a budget with a detailed salon expenses list is one of the first steps to successfully starting or managing your salon. From initial investments like equipment and licensing to ongoing costs such as rent, utilities, and staffing, knowing exactly what to expect helps you stay on track financially. If you’re in the early stages, understanding how to open a salon successfully and manage start-up costs can ensure your planning covers every essential detail. With a clear picture of your expenses, you’ll be ready to build a thriving salon business.

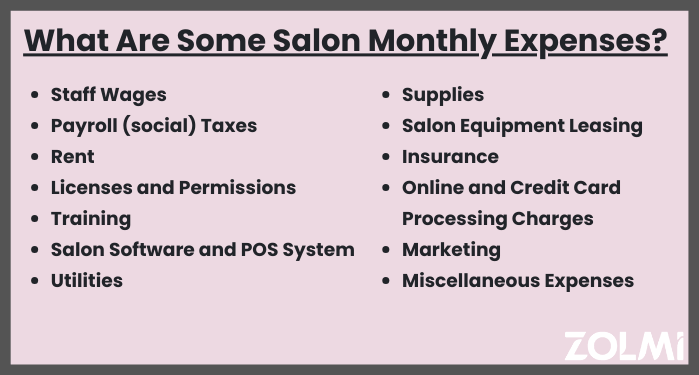

We’ll go over some common salon expenses that you should plan for, and what you can do to minimize or eliminate them.

The term “Salon Overhead” covers a variety of hair salon expenses, and usually includes things like your salon equipment, salon product inventory, and the supplies that your stylists use- including hair color or styling products. It also covers your financial expenses, such as staff payroll, any taxes that you pay, maintenance, and business insurance for your salon. These are all things that you’ll need to understand and keep track of in order to stay in control of your overhead costs.

Now, let’s take a look at all of these items in a little more detail.

Salon expenses can be divided into two categories: Recurring Expenses and Occasional Expenses. While it’s important to keep an eye on a salon’s occasional expenses, it’s not always possible to predict exactly what these fees will be, or how they will affect your profit margins. Recurring expenses, however, can and should be accounted for. They’re the average costs that have to be paid each month, so you’ll have a good idea of how each recurring expense will impact your revenue profits and bottom line.

Let’s start with a breakdown of recurring expenses. Recurring expenses are the costs that you can expect to pay regularly, usually every month. These costs are easier to budget for, especially if you use salon software to track your business expenses in one place.

People often ask “What is the largest expense in operating a salon?” The answer is usually salaries. The average stylist in the U.S. makes nearly $30,000 a year. This can quickly add up if you have a lot of staff. Keep track of your payroll costs.

These costs will vary, depending on your business location. Make sure and do some research about what’s required in your area and set aside some money to cover these costs.

Do not miss our post on Hairstylist Tax Write Offs.

If you’re still choosing a salon business location, check out the average rent prices in your area online. These will depend a lot on location. Businesses usually pay higher rent than residential properties, so it’s important to stay informed and have a dollar amount in mind when you plan your salon’s budget. If you’re able to save on rent, this will add a lot more money to your overall revenue by reducing the overhead expense.

Business licenses are necessary, but they vary depending on the city, state, or province. You will probably need health and safety inspections and certificates. In some places, you’ll be free to sell retail products related to your hair salon, but in other locations, you will need to pay for a permit. Check your state’s website and the website for your city to see what’s required.

To determine your overall salon expense amounts and to get the formula that you can use to begin creating a profitable pricing strategy check out our post on salon cost calculator.

Most likely, you’ll eventually want to invest in some additional education, training, or professional development for each stylist at your business. Salons often seek out new training to stay up to date with the latest beauty service trends or techniques. The beauty industry is always changing, and this means that businesses need to keep up. Education is key here. A new training course or license won’t be free, but if salon owners work with each employee and choose carefully, the long-term profits from education investments will add a lot to your revenue and raise your salon’s monthly income. Plus, it’s a great way to build employee loyalty.

These systems vary in cost, depending on your salon's needs. Decide on exactly what metrics you want to track (for example, do you want to know when your product stock should be reordered, what appointments are coming up, or how much revenue each stylist has generated, so far)? Once you know this, you can find something that fits your requirements. A POS system is important for processing transactions, but remember that it might also need specific equipment (such as iPads, if it uses wifi), and receipt paper.

No matter what services they offer, or what industry they’re in, businesses all have to pay for utilities. Salons all need electricity, water and heat, of course. So, it’s a good idea to look up the average costs and salon pricing for these services in your area. To give you an idea, the average electricity bill for a beauty salon starts at around $150 per month, and water bills can cost from $45 to over $150 for the largest and busiest hair salons.

In addition, you’ll have to consider the cost of internet service and a phone line. A reliable internet connection is important for things like processing payments, maintaining your salon’s social media presence, and doing any online marketing.

When starting your salon business, you should have enough beauty supplies and essential tools ready for each employee to use. Remember to include these business costs in your monthly costs/ expense budget. A salon's back bar supplies typically include shampoos, sanitizers, conditioners, styling products, and any chemicals used during services (such as perm solution and hair color). If you also run a nail salon, you’ll want to budget for the cost of specialty polishes and manicure products, too.

This is not the stock that your employees use on clients, it’s your supply of retail products. A large amount of a hair salon revenue comes from product sales, so it’s essential to have enough inventory ready for your employees to make add-on sales and recommendations.

Nowadays, leasing is one of the most popular ways to purchase equipment. Instead of paying in full or putting it on credit, you’ll set up a fixed monthly payment toward the cost of your equipment. At the end of the leasing period, your business usually has the option to pay off the final amount and own the equipment outright or renew your lease with the latest equipment, cutting down on any maintenance worries and keeping your hair salon at the cutting edge of the beauty industry.

Credit card processing fees can vary a bit, depending on your provider. The average charge you’ll encounter is around 1.5% to 2.7%, but be careful. Some companies will charge as much as 3% or more. As a salon owner or manager, be sure to do your research. These seemingly small changes can quickly eat up your revenue.

Monthly expenses for salon marketing vary widely, depending on your business strategy and the tools you use. An email marketing campaign or a hair salon newsletter can be quite inexpensive, especially if you have an employee who can help. The cost of placing an advertisement online or in print, particularly if you hire a professional to do it, can be very expensive.

Business insurance won’t be your biggest overhead expense, but it’s an important one. Insurance isn’t just a good idea, it’s a legal necessity. Salon owners should expect to pay anywhere from $500 to $700 a month for business insurance costs, depending on your salon services and location. There’s also the possibility that companies will offer additional business services, such as health insurance for your employees. Not all hair salons choose to offer this, but it might be something to consider if you want to attract and retain experienced staff. The dollar cost of insurance will vary a lot, depending on the location of your business. Do your research and see which providers fill your needs, and make sure to compare quotes.

Salon start-up expenses will include things like hiring stylists and staff, cleaning and retrofitting your new location, and advertising expenses for your new business.

If you decide not to lease equipment, you’ll need to purchase it. This will depend a lot on the type of salon business. Is it exclusively a hair salon? Does your business provide clients with nail care services or any other specialized beauty services, such as tanning, waxing, or spa services? These are all related expenses that can contribute to your basic equipment cost. If you need to purchase your basic equipment, you can expect to spend somewhere in the range of at least $27,000. This includes everything from chairs, shampoo stations, hood dryers, and hairstyling/ cutting tools. You can always start smaller, adding more equipment as you need it.

A well-designed salon with decor that stands out is important if you want to be competitive and generate more income. For example, a salon is more likely to be a success if it feels open and welcoming, not cluttered or dated. It’s important to budget for this when opening a new salon. Also, consider setting aside a portion of your profits each month towards future improvements or updates.

This is a big one. Not big in terms of expense; it’s just very important. This is a good time to get creative and shop around. Good signage can be surprisingly cheap if you shop around carefully. That said, a professionally made sign can also cost several hundred dollars, depending on your requirements.

Having an online presence is key to success as a salon, nowadays. Consider investing a little money (or time, at least) in a salon website. This does not have to be expensive, although you can hire a professional web designer if you want to profit from that “wow factor”. It’s also okay to start with something simpler, like an online template.

These are everything from the cash float in the till to any dollar amount that you need to spend on random emergencies. It’s a good idea to have at least $500 put aside to pay for unexpected things.

We also recommend you to check out our post How To Sell or Buy Used Salon Equipment.

To better understand the importance of tight salon expenses management, let’s have a look at some salon industry statistics. Based on the salon industry research done by salon coach Derek Hull from Salon Ops when we compare:

the reality can be really harsh:

Have regular meetings and talk with your staff. Make sure that they feel comfortable complaining to you about anything related to the salon that they think is inconvenient or problematic. Since they’re on the front lines, employees will often notice unproductive expenses first. Show that you’re on their side and that you value their input, then develop a plan to tackle the biggest expenses, first. You’ll be surprised by how much time and money you’ll save. You’ll also have happier staff and happier customers.

Good Salon Software and a POS system will save you time and money because it will track and record transactions as they happen. This is especially helpful for processing online transactions and credit card payments for your salon. Speaking from experience, the benefits of salon software far outweigh the costs, because of the time you’ll save. This is important for your business success and your own mental health. You can set schedules, track bookings, check your stock of products and see which stylists are hitting their targets, all in one place. This will cut way down on the stress of daily business operations and help free you up to focus more on your clientele.

Unsold or expired products won’t make you a profit.It’s important to have enough stock for sales and salon needs. On the other hand, products take up space. Too much clutter can look unprofessional and compromise hair salon safety. It’s a balance that you need to be careful of. Make sure to track this inventory and fill it up only when necessary, to avoid taking up space (which can fill up quickly in a busy hair salon) or creating waste. Wasted products or surplus stock can easily eat into your profit margins. Consider investing in some salon software to track fast-moving products and help manage your orders. You can even set up smart ordering when the stock reaches minimum levels. This will maximize your profit/ expense ratio and eliminate needless waste.

You can use scheduling software to avoid gaps between appointment bookings, send out automatic confirmations and reminders, and fill out any downtime in your salon. This will also free your staff up to take care of other tasks.

When your staff isn’t busy with clients, make sure that they’re cleaning, placing stock orders, posting content to the hair salon social media, or helping with other daily tasks.

In the long run, everyone will profit from this. Ideally, your staff all know how to perform each service, work the till or add to the salon’s website. Then, anyone can fill in where they’re needed and you won’t have to overstaff. Additionally, they’ll gain valuable experience for their resumes.

Remember, recruitment and training costs money. If you can keep your best/most famous stylists, you’ll retain the clients (and income) they bring in, too. The key here is to have good communication. Make sure that you have a good relationship with each stylist and keep the workplace environment positive.

Do you really need that many receptionists? What about someone whose whole job is just managing the stock room and orders? Salon scheduling and management software can eliminate the need for this much extra help. You can easily access figures for ordering products and balancing your books. Many younger clients also prefer to book appointments online in their own time, and this makes it easy for them.

Do your research and learn how much things cost. Check for any bulk discounts on products or benefit plans that suppliers offer. Learn what expenses you can claim on your income tax, later on.

Avoid clutter or wasted space. It looks unprofessional and can become a safety hazard. Also, make sure that you maximize each service space. A good rule of thumb is to have one backwash for every three service stations.

Things like email marketing, salon loyalty programs, and encouraging client reviews are an effective and inexpensive ways to increase your profit margins. You can also have incentives in place for customer referrals. Of course, all of this can easily be managed using salon marketing software.

Combined with a salon expense spreadsheet, these tools will help you to stay aware and on top of your expenses. You can track income and expenses over time and see where you’re spending the most. Then, you can make any adjustments or eliminate unnecessary expenditures.

The beauty salon budget that you create should include financial costs, as well as any purchases. This starts with location rent, any business license fees required in your state or province, as well as employee salaries and payroll. You’ll want to take taxes into account, too. Always set money aside for taxes, when you’re calculating profit. This will save you from worrying about a lot of the fees, later on. Consider hiring a professional to help you file your taxes and do salon accounting, even if you prefer to do your own bookkeeping.

We also recommend you to check out our post Are Hair Salons Recession-Proof.

We have prepared a useful template that will help you better organize the expenses in your salon.

Fill out the form below to get your free salon expenses template.

Running a hair salon is not cheap. That said, salon owners and managers can make a healthy profit if they are smart and use their resources well. The trick is to be attentive and eliminate waste: wasted time, wasted products, and wasted effort. All of these things have a dollar value. Salon expenses don’t have to be a big deal. If you budget carefully and communicate well with your clients and staff, it’s easy to stay on top of them.

And if you love these ideas or have some other ideas that you've used in the past to promote your salon business, why not share them with the Zolmi community in the comment section below. We would also be delighted to answer your questions, as well.

An empirical analysis of mutual fund expenses

https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1475-6803.1997.tb00243.x

Technology investment and business performance

https://dl.acm.org/doi/pdf/10.1145/256175.256191

Administrative Expenses

https://books.google.com/books?hl=en&lr=&id=mZtTtPOGCjgC&a